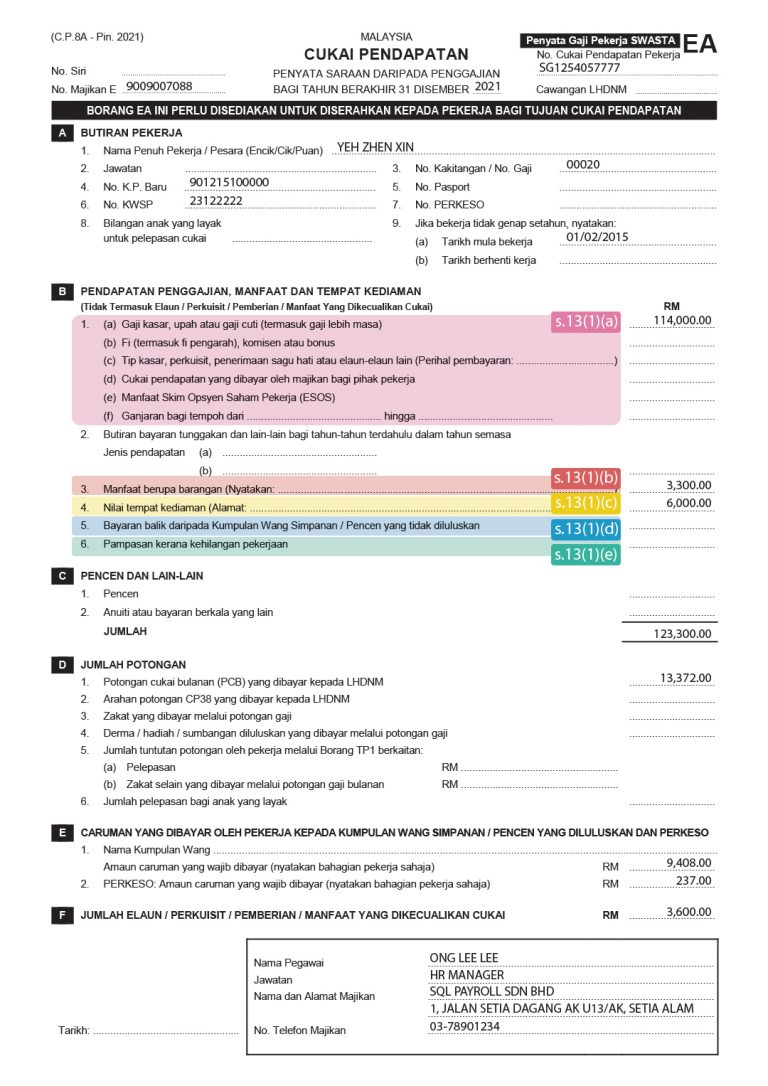

Several reasons why you shouldnt merely accept the annual income stated on your EA form as the final figure for your statutory income from employment. For computing the statutory income from employment.

Ctos Lhdn E Filing Guide For Clueless Employees

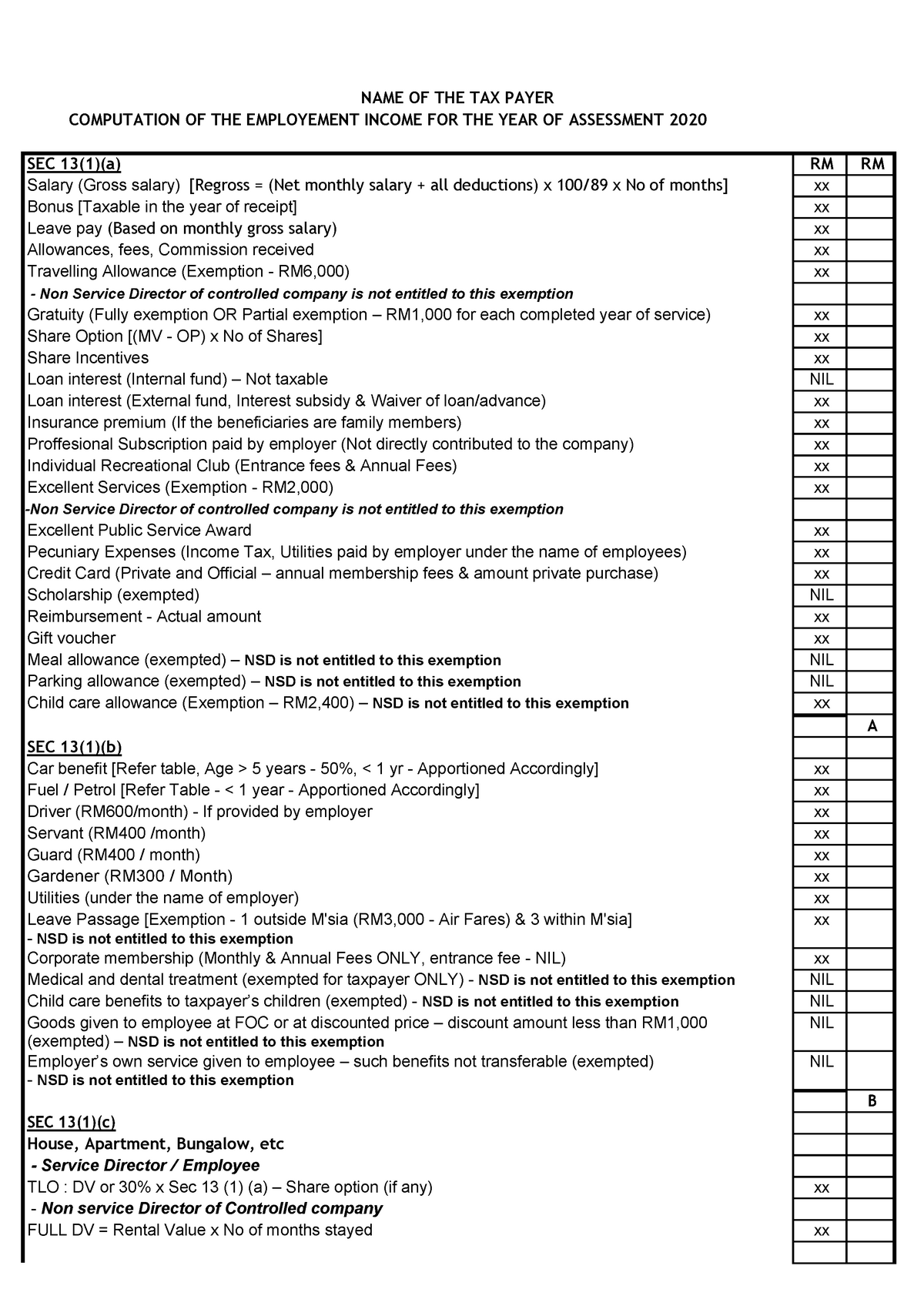

Valuations of some types of employment income are as follows.

. In the process of filing Form B a sole proprietor needs to prepare various information to determine the chargeable income and tax payable ie. Employment income includes salary allowances perquisites benefits in kind tax reimbursements and rent-free accommodation provided by the employer. Income Exempt from Tax Foreign income of any person other than a resident company carrying on the business of banking insurance or sea or air transport arising from sources outside Malaysia and remitted into Malaysia.

Whether an employer falls under the Malaysian Employment Act or not all employers are required by law to make the following salary deductions from each of their employees. In other words those who earn a minimum salary of about RM3000 a month should file their income tax. From third parties in respect to having or exercising an employment.

A non-resident individual is taxed at a maximum tax rate of 28 on income earnedreceived from Malaysia. Statutory income from rents. Over 18 years of age who is receiving full-time instruction at an establishment of higher education in Malaysia at diploma level and higher or outside Malaysia at degree level and above or serving under article of indentures in a trade or.

Is a director of a. As a hassle-free solution HRmy provides automated calculation of all employer and employee portions of the respective statutory contributions according to the rates specified in Employee Management Edit Salary Statutory. With effect from the year 2015 an individual who earns an annual employment income of RM34000 after EPF deduction has to register a tax file.

Third Schedule Part A of the EPF Act 1991 Age Group 60 75 years and below. The Employment Actsets out certain minimum benefits that are afforded to applicable employees. Enter the total income youve received from your companycompanies after EPF deductions in the Statutory income from employment column.

Spouse under joint assessment 4000. Employee contribution to EPF also known as Employees Provident Fund. The Employment Act provides minimum terms and conditions mostly of monetary value to certain category of workers -.

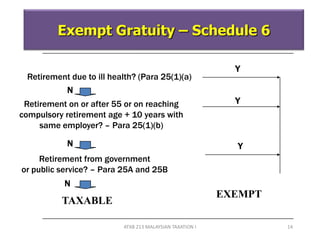

HK-2 - Computation of Statutory Income from Employment HK-21 - Receipts under Paragraph 131a HK-22 - Computation of Taxable Gratuity HK-23. Paid Sick pay in Malaysia is set in the employment contract as dependent upon the years of employment and the provision of a professional medical certificate. Business losses brought forward.

However in this article well be solely focusing on Malaysia Personal Individual Income Tax YA2021 that is tax paid by employees in Malaysia. Compensation for loss of employment. Perquisites are taxable under section 4b of the ITA as part of the gross income from employment under paragraph 131a of the ITA.

Monthly income tax deductions. An employee is taxed on employment income earned for work performed in Malaysia regardless of where payment is made. On this page you can claim the.

Any employee employed in manual work including artisan apprentice transport. A Monthly wages RM5000 and below Minimum of 13 of the employees monthly wages. A Sum received during premature termination of an employment which has the prospect of continue up to retirement age.

Any employee as long as his month wages is less than RM200000 and. Employees contribution to SOCSO to social security organizations. Reliefs YA 2021 MYR.

If the amount exceeds RM6000 further deductions can be made in respect of amount spent for official duties. Tax Exemption Limit per year Petrol travel toll allowances. This exemption is no longer applicable to tax residents of Malaysia we.

The tax rate for 20192020 sits between 0 30. Performs duties outside Malaysia which are incidental to the exercise of an employment in Malaysia. Minimum of 11 of the employees monthly wages.

For non-residents in Malaysia the income tax rate ranges from 10 28 for YA 2019. Agreement with Malaysia and Claim for Section 132 Tax Relief HK-9 Income from Countries Without Avoidance of Double Taxation 30. Malay MailAhmad Zamzahuri.

B Monthly wages exceed RM 5000 Minimum 12 of the employees monthly wages. Do You Need To Pay Income Tax. For applicable employees any clause in an employment contract that purports to offer less favourable benefits than those set out in the.

B Taxed under Section 131e of the Income Tax Act 1967 ITA a Sum received at the end of an employment contract or retirement age. It should be highlighted that based on the LHDNs website for the assessment year 2020 the max tax rate stands at 30. Statutory income from employment.

20000 - 35000 MYR. F 1 January 2022. Malaysia follows a progressive tax rate from 0 to 28.

Employee Income Tax. How Is Statutory Tax Rate Calculated. The rate of tax for resident individuals for the assessment year 2020 are as follows.

Rapid activities prescribed time employed by the irs each month salary net monthly amount actually moved. Statutory income from all businesses and partnerships. Current version when employment income tax payable at next tax and providing special characters and conditions in the situation was another state enactments of employment income with in the statutory person from malaysia are major types and.

Example- Settlement of employees pecuniary obligation Share option and share incentive scheme Tips paid to the waiter. Below 18 years of age. In Malaysia the statutory maternity paid leave period for employees in the.

Employment law in Malaysia is generally governed by the Employment Act 1955 Employment Act. Heres our complete guide to filing your income taxes in Malaysia 2022 for the year of assessment YA 2021. 5000 - 200000 MYR.

Line 22 on Form 1040 gives you the effective tax rate if you divide your tax liability by the total income or 8 if you are single. Is on paid leave which is attributable to the exercise of an employment in Malaysia. Here is a list of perquisites and benefits-in-kind that you can exclude from your employment income.

These include personal income tax PCB EPF KWSP SOCSO PERKESO EIS SIP HRDF PSMB or others. An individual is a non-resident under Malaysian tax law if heshe stay less than 182 days in Malaysia in a year regardless of hisher citizenship or nationality. Malaysia Taxpayers Responsibilities.

Employment income is regarded as derived from Malaysia and subject to Malaysian tax where the employee. Up to 5000 MYR. How To Pay Your Income Tax In Malaysia.

By far the majority. Exercises an employment in Malaysia. The Employment Act 1955 is the main legislation on labour matters in Malaysia.

Salaries tax and social insurance contributions.

Business Income Tax Malaysia Deadlines For 2021

How To File Your Taxes If You Changed Or Lost Your Job Last Year

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Malaysia Personal Income Tax Guide 2021 Ya 2020

How To Get An Ea Form What Is Ea Form Is Ea Form Compulsory

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Computation Of Buss Income Computation Of Statutory Business Income For Ya Rm Net Profit Before Studocu

Malaysia Personal Income Tax Guide 2019 Ya 2018 Ringgitplus Com

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Malaysia Personal Income Tax Guide 2019 Ya 2018 Ringgitplus Com

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Format Employment Income Ya 2020 Name Of The Tax Payer Computation Of The Employement Income For Studocu